I bond calculator future

Related Investment Calculator Future Value Calculator. The formula for calculating YTM is shown below.

Ti Ba Ii How To Compute Bond Price Or Yield When Settlement Date Falls On Coupon Date Tiba2 03 Youtube

The payment number is N the shows N as an exponent.

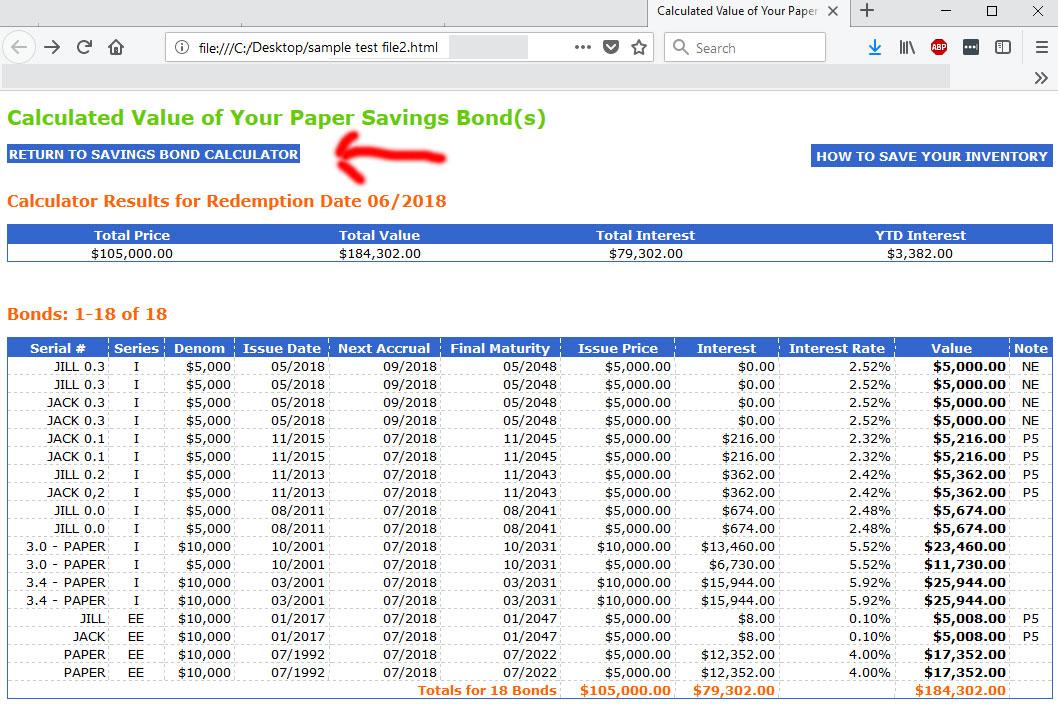

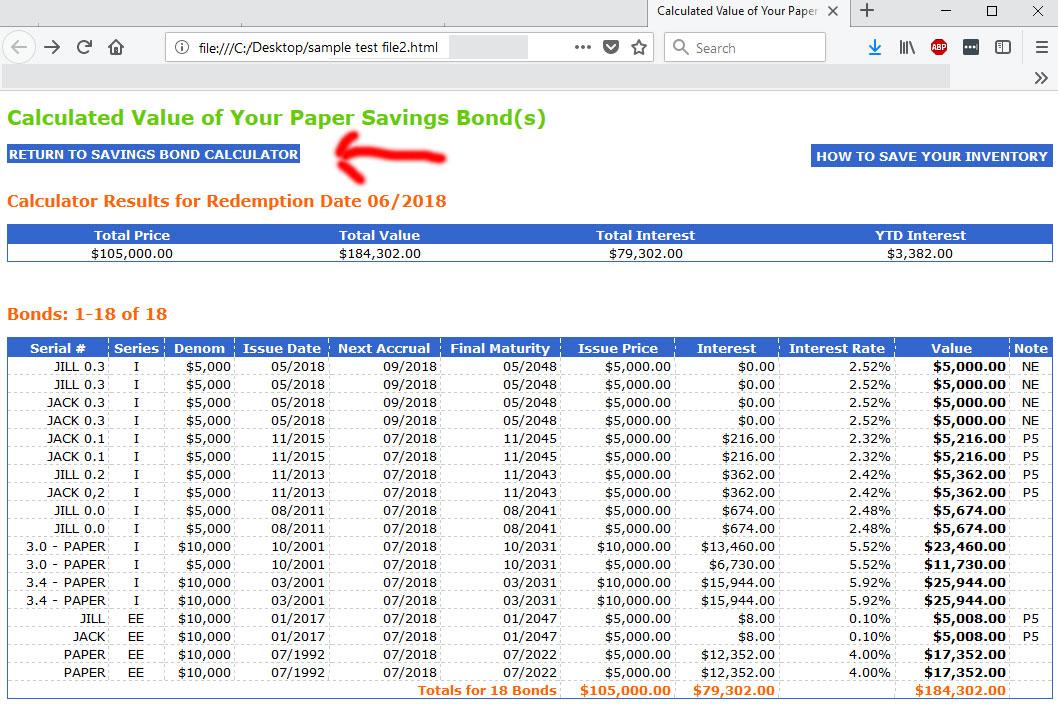

. The higher the Rate of a deal the higher the future price. Google Chrome not compatible Google Chromes saving process currently is not compatible with the Savings Bond Calculator. The total number of bond payouts in the future assuming no missed payment yield.

A 6 year bond was originally issued one year ago with a. If youd like to know how to estimate compound interest see the article. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

This calculator can help you determine the monthly repayments based on the Home Loan amount and chosen term as well as the costs you need to be aware of when financing a new home. The readout will include all pertinent information about the bond including its value for the current date in the value field and the interest earned up to this point. Yield to maturity YTM is similar to current yield but YTM accounts for the present value of a bonds future coupon payments.

The market price of. Future value of an ordinary annuity the formula F P 1 IN 1I is calculated in which case P is the payout amount. Future versions of this calculator will allow for different interest frequency.

The future value of the annuity is shown in the letter F. While that may sound complicated in practice it is much easier than it seems. Example of Zero Coupon Bond Formula with Rate Changes.

Put a calculator on your site for free. I am equal to the interest rate discount. Calculate bond value.

It sums the present value of the bonds future cash flows to provide price. Return Rate Discount Rate CAGR Calculator. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator.

It matures in five years and the face value is 1000. The yield of the bond at point x remember yields are often annualized this yield must be adjusted for periods per year. Home Loan Bond Calculators Before you make the final decision to finance a property you need to understand the costs involved and how much you can afford.

If you use Chrome as your default web browser youll need to use an alternative browser to save an inventory for future use in the Calculator. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. Using the 1000 example if a bond has a 3 coupon the bond issuer promises to pay investors 30 per year until the bonds maturity date 3 of 1000 par value 30 per annum.

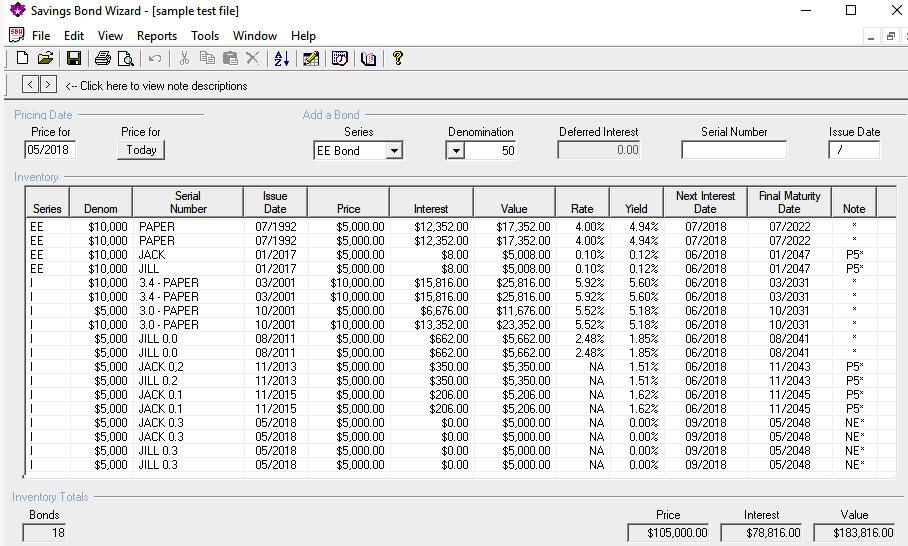

Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. If you own or are considering purchasing a US. Known as the Savings Bond Calculator it can help you make.

It is assumed that all bonds pay interest semi-annually. To use bond price equation you need to input the following. To find what your paper bond is worth today.

The purpose of this calculator is to provide calculations and details for bond valuation problems. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. Savings bond the US.

Bond Yield Mortgage Retirement. The payout of the bond at point x. 24300 Little Mack St.

If a bond was issued May 1997 or later and its cashed before its five years old its subject to a three-month interest penalty. The payout at maturity when the bond matures or the par or face value. Issue PriceThe money you paid to buy each paper bond in this inventory.

It returns a clean price and dirty price market price. InterestThe amount of interest each paper bond has accumulated from its Issue Date through the Value as of date. The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic depositannuity payment per period PMT.

Click the Get Started Link above or the button at the bottom of this page to open the Calculator. Once open choose the series and denomination of your paper bond from the series and denomination drop-down boxes. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

Click the Get Started Link or button on the Savings Bond Calculator home page. Feds Mester backs rates above 4 early next year no 2023 cuts. A bond ladder can help investors earn a steady stream of income from their security holdings while increasing the potential for greater returns should interest rates rise in the future.

Typically cash in a savings account or a hold in a bond purchase earns compound interest and so has a. Clair Shores MI 48080 TOLL-FREE. A bond ladder is a portfolio of individual bonds that mature at different rates.

After solving the equation the original price or value would be 7473. Future Value Compound Interest EMI Calculator. P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years to maturity.

After 5 years the bond could then be redeemed for the 100 face value. Return Rate Formula. In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Suppose a bond is selling for 980 and has an annual coupon rate of 6. Compound Annual Growth Rate.

To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button. When youve entered all of your data press the calculate button and the page will refresh with your bonds value calculated below the calculator inputs. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for determining the present and future value--as well as historical information current interest rate next accrual date final maturity date and year-to-date interest earned.

If you report savings bond interest to the IRS every year. See the CAGR of the SP 500 this.

Bond Calculator Calculates Price Or Yield

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

1

Bond Pricing Formula How To Calculate Bond Price Examples

1

Bond Price Calculator Exploring Finance

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

How To Calculate Carrying Value Of A Bond With Pictures Cpa Exam Bond Raising Capital

Bond Yield Calculator

How To Calculate Bond Price In Excel

3

Bond Price Calculator Exploring Finance

Yield Formula Chemistry

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

Valuation Of Bond Or Debenture Find Out More Bbalectures Com Bond Business Articles Financial Markets